From “Mother of Electronics” to Capital Hotspot: Decoding the PCB Industry Boom

As the “الشبكة العصبية” of electronic components, لوحات الدوائر المطبوعة (مركبات ثنائي الفينيل متعدد الكلور) have served as the foundational carrier of the electronics industry since their invention in 1943. From smartwatches to supercomputers, and from 5G base stations to space probes, the precision of PCBs directly determines the performance boundaries of electronic devices. في وقت مبكر 2024, this traditional industry emerged as a dark horse in capital markets: leading companies like Shengyi Technology (600183.SH) and Dingtai Advanced Materials (301377.SZ) saw consecutive stock surges, with the sector index rising over 23%, drawing intense market attention.

According to the latest Prismark report, global PCB output is projected to reach $73.346 مليار في 2024, أ 5.5% year-on-year increase, marking a recovery from the 2023 downturn. More notably, the industry exhibits structural divergence—the top five companies account for over 29% of total revenue, while more than half of the 30 leading firms achieved double-digit growth. هذا “Matthew Effect” reflects transformative shifts driven by technological innovation.

Technological Evolution Trilogy: Synergy of AI Servers, Optical Communication, and Smart Devices

AI Computing Revolution Sparks High-End PCB Demand

The launch of NVIDIA’s GB200 servers signals the arrival of thousand-card AI computing clusters. A single NVL72 cabinet’s PCB value reaches $171,000, second only to GPU costs. This explosive growth stems from three breakthroughs:

- Multilayerization: AI server PCBs now exceed 20 طبقات, up from 8–12 layers.

- High-Frequency Performance: Signal transmission rates surpass 112 Gbps, reducing the dissipation factor (Df) below 0.002.

- Integration: HDI boards achieve line width/spacing of 40μm, with blind via depth accuracy controlled within ±10%.

Optical Communication Upgrades Unlock New Opportunities

UGPCB’s 800G optical module PCBs, featuring laser drilling precision of 25μm and interlayer alignment tolerance under ±15μm, have entered mass production.

Smart Device AIization Forces Process Innovation

Apple’s iPhone 17 will debut A19 chips with substrate line widths under 20μm, while foldable Android phones drive penetration of any-layer HDI beyond 45%. IDC data shows global smartphone shipments grew 6.4% in 2024, with AI phones constituting over 30%, fueling demand for advanced PCBs.

Industry Upgrade Roadmap: From Scale Expansion to Value Leap

Material Innovations Drive Performance Breakthroughs

Leading Chinese manufacturers focus on:

- Low dielectric constant (Dk <3.5) copper-clad laminates (CCL).

- Metal substrates with thermal conductivity >1.5 W/m·K.

- Resin systems resisting conductive anodic filament (CAF) for over 1,000 hours.

Process Innovations Build Technical Barriers

UGPCB’s “pulse plating + laser etching” hybrid process for 800G modules controls impedance tolerance within ±5%, while its PCBs for humanoid robots and drones ensure stable supply.

Diversified Applications Expand Horizons

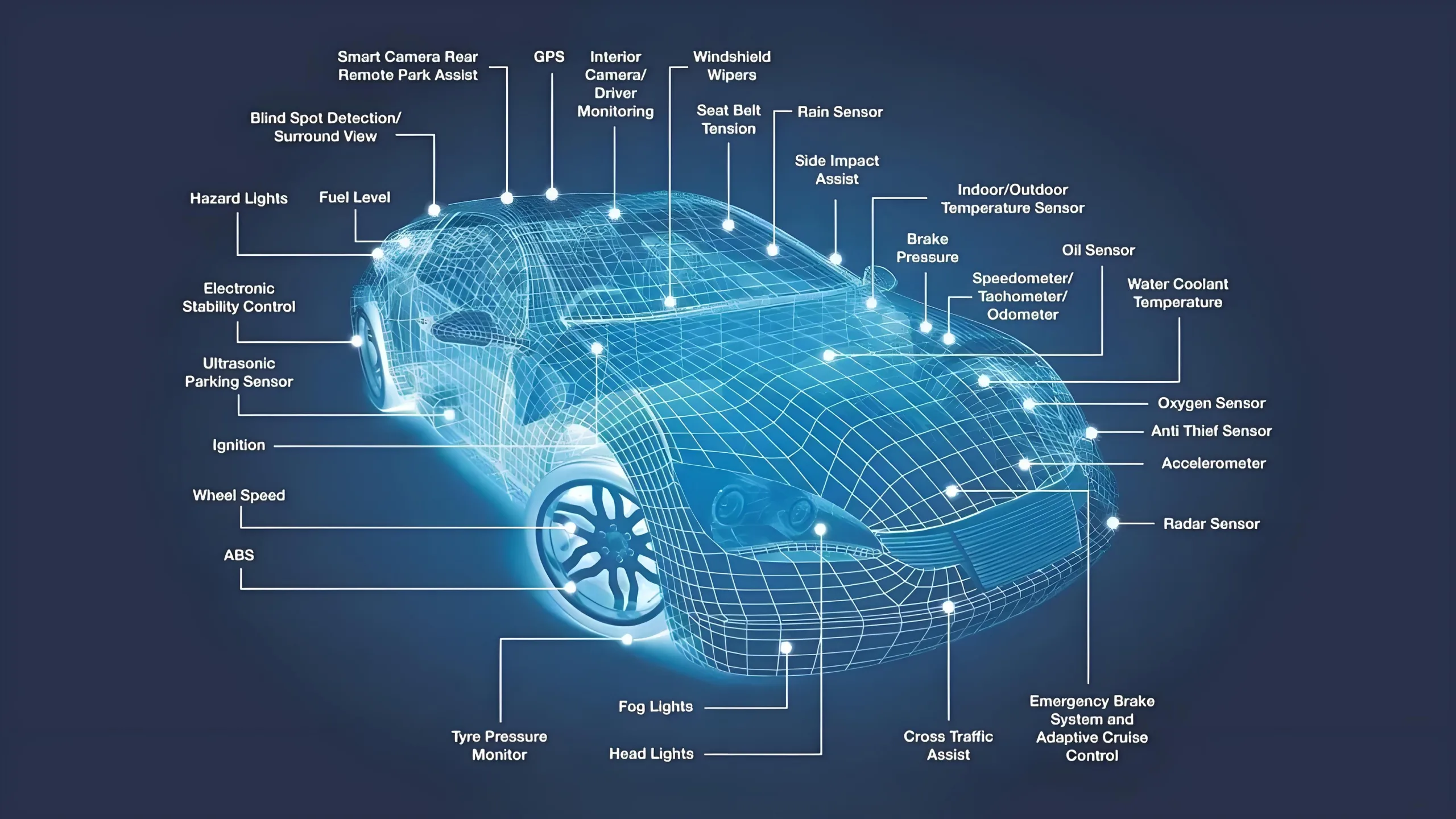

In smart vehicles, PCB value per car surges from 500. CATL’s latest battery management system (BMS) employs 24-layer rigid-flex boards with a temperature range of -40°C to 150°C. Humanoid robot joint control boards require vibration resistance up to 20G acceleration.

Opportunities and Challenges in Domestic Substitution

Reshaping the Global Landscape

China holds 53% of global PCB capacity but contributes under 15% to high-end products. Unimicron dominates 32% of the ABF substrate market, while mainland firms like Dongshan Precision achieve 85% yield in 5G mmWave antenna modules via strategic acquisitions.

Structural Growth Opportunities

- Servers: Prismark forecasts an 11% CAGR (2023–2028), with single-unit PCB value exceeding $705.

- Automotive Electronics: Auto PCB output to hit $14.5 billion by 2026, with ADAS boards exceeding 40%.

- IC Substrates: Global market to reach $21 billion by 2025, growing at 14% CAGR.

Hidden Risks in Capacity Expansion

Guojin Securities data reveals inventory turnover days rising to 68 in November 2024, with some manufacturers’ ROIC falling below 8%. The imbalance between high-end shortages and mid/low-end oversupply tests strategic resilience.

Future Battleground: From Manufacturing Hub to Innovation Epicenter

Stimulated by Microsoft’s 80billionAIdatacenterinvestmentandMicron’s7 billion advanced packaging plans, Chinese PCB firms are executing a “triple leap” in product sophistication, smart manufacturing, and supply chain collaboration.

As industry expert Gao Chengfei notes, “When PCB line widths are measured in micrometers, competition shifts from cost control to technological ecosystem building.” The revolution ignited by AI and new energy is redrawing the global electronics value chain. Enterprises establishing moats in materials science, process engineering, and system design will dominate the trillion-dollar smart hardware era.

خاتمة

From consumer electronics’ cyclical recovery to AI server demand explosions and smart vehicle adoption, the PCB industry is undergoing unprecedented technological convergence. Chinese companies face both growing pains in transitioning from “حجم” ل “strength” and historic opportunities to redefine supply chain leadership. When a single circuit board’s value is measured in tens of thousands of dollars, this contest transcends manufacturing prowess—it is the ultimate showdown of innovation ecosystems.

شعار UGPCB

شعار UGPCB